Unlock Revenue Potential: AWS SaaS Revenue Recognition Program

Discover how AWS's new SaaS Revenue Recognition Program can help APN Partners boost sales, enhance co-selling, and unlock new revenue opportunities.

A Finance leader's guide to cloud marketplace accounting, covering revenue recognition, fees, AR, cash flow and reconciliation across AWS, Azure and GCP.

Sales just closed another seven-figure deal through AWS Marketplace. The customer's burning down their committed cloud spend, the rep hit quota, and the C-suite is celebrating another win in the cloud era.

While everyone's celebrating, Finance is staring at the contract in Salesforce and thinking:

The pattern repeats every quarter: Revenue gets recognized in January. Cash arrives in April. And the reconciliation? That's happening across spreadsheets, marketplace portals, and your CRM at 11 PM on the last day of the quarter.

This is the first chapter of a Finance Cloud Marketplace Playbook centered around one core problem:

Cloud marketplace accounting forces you to make consequential accounting decisions with incomplete information, reconcile transactions you don't control, using systems that weren't natively built for this.

By the end of this chapter, you should be able to:

Finally, we hope after reading this you'll be celebrating a little too (why should Sales have all the fun?)

Cloud GTM breaks the link between revenue, cash, and ownership. Finance is still accountable for all three.

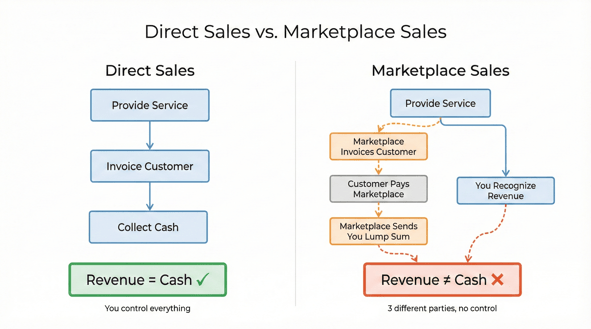

In traditional software sales, you deliver the service, you bill the customer and you collect the cash, so revenue recognition, accounts receivable, and cash flow make sense.

As shown in the illustration above, cloud marketplaces deals fracture that sequence entirely. Finance still has to recognize revenue correctly, reconcile cash, pass audits, and forecast accurately.

The following three problems expose where this broken model forces finance into impossible positions.

Marketplace revenue forces finance into subjective accounting decisions that current standards aren't clear on.

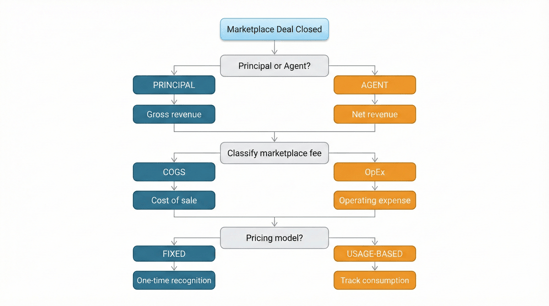

Marketplaces insert a third party into the transaction, creating three judgment calls that directly affect your reported revenue, margin profile, and valuation:

Let's examine each.

This is the most immediate and material accounting challenge for finance teams in a Cloud GTM model.

An entity is a principal (recognizing gross revenue) if it controls the good or service before transfer. Conversely, an agent (recognizing net revenue) merely arranges for another party to provide it.

The complexity deepens with multi-party offers (CPPOs or MPOs), which introduce a fourth party to the mix. Here, the ISV sells to a Channel Partner, who then sells to the end customer via the marketplace.

In practice, most SaaS vendors conclude they are the principal—they provide the product, set pricing, own the EULA, and handle service delivery. This means recognizing gross revenue and treating the marketplace's cut as an expense. Finance teams must document their assessment against three primary indicators:

Why it matters: Gross vs. net presentation affects top-line revenue and growth metrics. This policy can materially impact valuations and benchmarks for high-volume sellers.

Once you've established principal status, the next question is: how do you treat the marketplace fee on your P&L?

Should fees be Cost of Goods Sold (COGS) or Operating Expenses (OpEx)? Industry practice is split according to GaapSavvy:

Our recommendation: We prescribe OpEx classification as best practice. Marketplaces function as sales channels, making the fee analogous to channel partner compensation. However, many teams default to COGS as more defensible. No explicit standard dictates treatment. Make a policy decision, document the rationale, maintain consistency, and prepare to defend it to auditors

For usage-based or consumption pricing, you recognize revenue as usage happens, requiring real-time tracking and integration between marketplace metering data and your revenue systems. You must estimate variable consideration at contract inception, then update as actual usage data arrives. At period-end, you may need to accrue for unbilled usage—creating estimation risk on top of delayed data and deferred revenue schedules that multiply with each transaction.

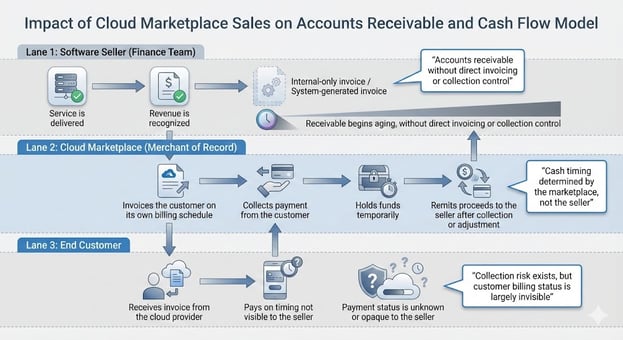

When you account for revenue as principal, you must record AR for the full amount. But in marketplace sales, you didn't invoice the customer and you don't control collections. This creates three compounding problems:

When selling direct, you invoice the customer and manage collection. In marketplace sales, the cloud provider invoices the customer on your behalf as the merchant-of-record.

But you still need to record a receivable and track its collection. The result: you carry AR on your books for sales you didn't bill, with limited visibility into the customer's payment status.

You don't have to send these to customers (they're paying the cloud provider) but the invoices allow your system to:The workaround: According to a GaapSavvy survey, 63% of companies create "dummy" or ghost invoices in their ERP.

Most companies list the end-customer name on these invoices and classify them as normal trade receivables, aligning with the economic reality that you're owed money for delivering the service.

Creating dummy invoices is just the beginning. The cash flow timing creates a second layer of complexity.

Cloud marketplaces pay out funds on a delayed cycle:

Example of a typical cycle: January sale via Azure (net-30 terms) → Microsoft invoices in January → collects in February → pays you mid-March. Your books show A/R in January, cash receipt in March.

Magnitude of impact: For high-volume sellers at $100M+ marketplace revenue annually even 5 days of delayed payment equals significant lost interest income.

The delayed cash flow would be manageable if you could at least track collection status. But you can't.

While cloud providers perform credit checks, default risk still flows back to you:

Cloud marketplaces share minimal customer billing and credit information. You often won't know if a deal is on extended terms or facing collection issues until the payout is delayed. This makes cash forecasting difficult and may require opening support tickets to investigate specific unpaid accounts.

Without shared identifiers across systems, reconciliation shifts from accounting work to detective work.

For high-volume sellers, this is where operational pain becomes acute. The reconciliation challenge has three layers:

Each layer compounds the others.

The fundamental problem is simple but crippling:

There is no shared unique identifier linking all four. Finance teams must triangulate using customer names, amounts, and dates, none of which align perfectly.

When a $61,000 disbursement arrives, you don't know if it represents:

Most companies resort to spreadsheets, manually matching invoice amounts across buyers to figure out which deals sum to $61,000. Marketplaces provide some metadata (bank trace ID, invoice ID), but it's inconsistent across platforms and rarely matches the identifiers in your other systems.

The net-to-gross reconciliation layer: The bank deposit shows the net amount (after marketplace fees). You need to:

For companies selling across AWS, Azure, and GCP simultaneously—each with different fee structures and reporting formats—this manual work can add days or weeks to close cycles.

Selling globally introduces foreign exchange as another reconciliation variable. Marketplaces apply exchange rates (typically Bloomberg) at invoice time, not offer acceptance.

If you close a ¥700,000 deal on January 1 but the invoice goes out January 15, you're exposed to FX fluctuation between those dates. The ISV bears the exchange risk and must reconcile FX impacts across three different moments—all potentially at different rates:

The three themes above aren't theoretical, they're daily reality for finance teams managing marketplace revenue. At low volumes, you can muscle through manually. Spreadsheets work. Close takes an extra day, but it's manageable. As deal volume on marketplace grows, manual processes break down entirely. You need automation or you're looking at materially longer close cycles, audit risk, and potential revenue leakage.

Solving marketplace finance at scale requires three foundational elements:

Before you can automate anything, you need documented decisions on the judgment calls:

These aren't one-time decisions. As you expand into new marketplaces or new deal structures (CPPO, usage-based), you'll revisit these policies.

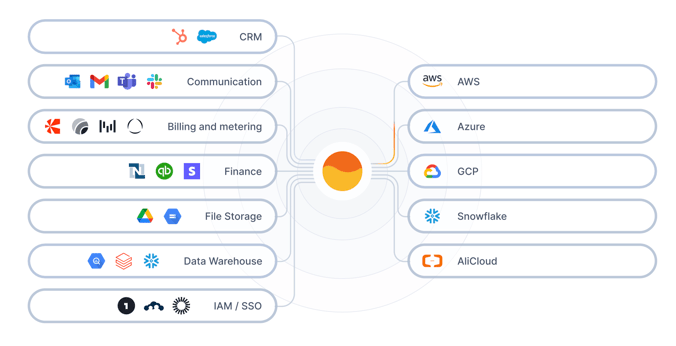

The core problem is data fragmentation across disconnected systems. You need a unification layer that:

This is where platforms like Suger function as the connective tissue. Suger pulls data from marketplace APIs, links it to your CRM records (Salesforce, HubSpot), and prepares the accounting entries your ERP needs.

Instead of manually matching a $100,000 bank deposit across three spreadsheets, the system automatically maps: Marketplace disbursement → specific entitlements → CRM opportunities → ERP invoices

Suger's revenue record APIs track disbursements, link them to entitlements, and expose webhook notifications when cash arrives—turning the lump-sum matching problem into a structured data flow.

The goal isn't just visibility, it's eliminating manual steps entirely. Best-in-class implementations automate the order-to-cash cycle:

Suger's workflow builder lets you construct these automations visually, connecting marketplace events to actions in your CRM and ERP. The integrations with Salesforce, HubSpot, and NetSuite are native, and custom workflows are supported via API.

This turns reconciliation from a detective work into an automated process with exception-based reviews, the way month-end close should work.

According to benchmarks, top SaaS companies transact 20-40% of new bookings through marketplaces. For some, it's over 50%.

When marketplace revenue reaches that scale, the finance challenges we've outlined stop being occasional inconveniences and start being systemic risks:

The fix isn't more spreadsheets or more headcount. It's treating marketplace revenue the way you treat any other significant revenue stream: with clear policies, unified data, and automated processes.

If you're still reconciling marketplace revenue manually at 11 PM on the last day of the quarter, you're not solving a temporary problem, you're managing a permanent one badly.

Ready to go deeper?

We've built a comprehensive Finance Marketplace Best Practices Checklist that walks through everything you need to look out for.

Discover how AWS's new SaaS Revenue Recognition Program can help APN Partners boost sales, enhance co-selling, and unlock new revenue opportunities.

Automate cloud service metering with AWS, GCP, and Azure Metering APIs. Streamline cloud usage-based billing, accelerate revenue recognition, and...

A RevOps leader’s first guide to understanding why cloud marketplace deals create policy, workflow, and ownership failures, and what to do about it.

Be the first to know about Suger's latest features and new Cloud GTM insights.